Are you new to the world of business and wondering what a proforma invoice is? In simple terms, it’s an estimate that provides customers with an idea of what they will be charged for goods or services. It’s not a legally binding document like an invoice, but it’s essential in international trade and can help avoid misunderstandings and disputes between buyers and sellers. In this beginner’s guide, we will cover everything you need to know about proforma invoices – from their purpose and benefits to common mistakes to avoid when using them. We will also provide step-by-step guidance on how to create one and when to send it. So, let’s get started!

What is a Proforma Invoice?

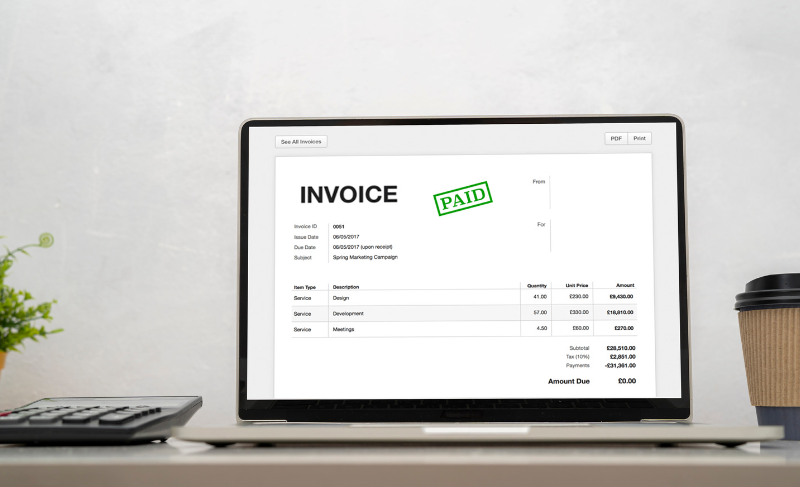

A proforma invoice is a preliminary bill of sale sent to buyers in advance of shipping the goods. It states the kinds and quantities of goods to be sold, their value, and other important information such as the shipping date(s), terms of sale, and seller’s name and address. Proforma invoices are not binding on the buyer or seller but they can help avoid misunderstandings by clearly stating what goods are being sold and at what price.

What Is the Purpose of a Proforma Invoice?

The purpose of a proforma invoice is to provide the buyer with an estimated cost for the goods or services being purchased. This allows the buyer to confirm that they can purchase the goods or services and also gives them an idea of when to expect delivery.

proforma invoices are often used in international trade, where there is a need to provide an estimated cost for customs purposes. They can also be used in domestic transactions, particularly when large purchases are being made.

Why Do Businesses Use Proforma Invoices?

Businesses use proforma invoices for a variety of reasons. One common reason is to provide customers with an estimate of the cost of goods or services before they are delivered. This can be helpful for both the business and the customer, as it allows them to plan and budget accordingly. Proforma invoices can also be used to secure financing or to obtain import/export licenses.

Additionally, they can be used as a way to document transactions for accounting purposes. By using proforma invoices, businesses can ensure that their financial records are accurate and up-to-date, which can help them make informed decisions and manage their finances more effectively. Overall, proforma invoices are a valuable tool for business marketing in many different industries.

What to Include on a Proforma Invoice?

When creating a proforma invoice, including several key pieces of information is important. Firstly, you should provide a detailed description of the goods or services being provided, including any relevant specifications or quantities. This will help ensure that you and your client are on the same page regarding the transaction. Additionally, be sure to include the total amount payable for the goods or services.

This should include any taxes or fees that may apply, as well as any discounts or credits that have been applied. Other details that may be useful to include on a proforma invoice include payment terms, delivery dates, and any other relevant information about the transaction. Including all necessary information on your proforma invoice can help ensure a smooth and efficient transaction with your clients.

How to Create a Proforma Invoice?

Creating a proforma invoice involves several steps to ensure that it accurately reflects the details of a potential sale. Here are the steps on how to create a proforma invoice:

1. Header Information

Start by including your company’s name, address, contact information, and logo at the top of the document. Also, prominently include the word “Proforma Invoice” to distinguish it from a regular invoice.

2. Seller and Buyer Details

Below the header, provide the details of the seller and buyer (your company). Include the full name, address, contact information, and any relevant identification numbers, such as VAT or tax registration numbers.

3. Invoice Details

Include a unique invoice number and the date of issuance. The invoice number helps in tracking the transaction, and the date ensures accuracy in record-keeping.

4. Itemized Listfit

Create a table with columns to list the products or services being offered. Include the following information for each item:

Description: Provide a brief description of the product or service.

Quantity: Specify the quantity being purchased or ordered.

Unit Price: State the price per unit of the product or service.

Total Price: Multiply the quantity by the unit price to calculate the total cost for each item.

5. Additional Charges

If applicable, include any additional charges or fees, such as shipping costs, taxes, customs duties, or handling fees. Clearly specify the nature of each charge and calculate the total.

6. Payment Terms

Outline the agreed-upon payment terms, including the due date, acceptable payment methods, and any discounts or incentives for early payment. Specify the currency in which the payment should be made.

7. Delivery Terms

Provide details about the delivery terms, such as the estimated delivery date, shipping method, and any shipping instructions or requirements.

8. Terms and Conditions

Include any relevant terms and conditions, such as return policies, warranties, or disclaimers. This section helps protect both the seller and the buyer by clearly stating the rights and responsibilities of each party.

9. Total Amount

Sum up the total amount payable by the buyer, including all item costs and additional charges.

10. Contact Information

Include your company’s contact information again at the proforma invoice’s bottom. Provide an email address, phone number, and any other relevant details for the buyer to reach out with questions or concerns.

11. Review and Send

Double-check the proforma invoice for accuracy, ensuring that all details are correct. Once verified, save the document in a format such as PDF or print it and send it to the buyer via email or other preferred communication method.

Remember, a proforma invoice is a preliminary document, not a legally binding agreement. It serves as a quotation or an estimate of the costs involved in a potential sale.

When Should Proforma Invoices Be Sent?

Proforma invoices should be sent before the sale is confirmed. These invoices are essential preliminaries outlining a transaction’s expected costs, including the price of goods or services, shipping fees, and applicable taxes or fees. They are often used in international trade to provide buyers with an estimate of costs before finalizing a purchase. By sending a proforma invoice before the sale is confirmed, both parties can review and agree on the terms of the transaction before any money changes hands. This can help avoid misunderstandings or disputes e and ensure that both parties are on the same page before completing the sale.

Benefits of Using a Proforma Invoice

There are many benefits of using a proforma invoice when conducting small business internationally. Perhaps the most important benefit is that it provides a written record of the transaction between the buyer and seller. This can be helpful in the event of a dispute. Additionally, a proforma invoice can help ensure that both parties are clear on the terms of the sale, such as price, quantity, and delivery date. This can help avoid misunderstandings down the road.

Another benefit of using a proforma invoice is that it can streamline the payment process. For example, if the buyer needs to obtain financing for the purchase, they can use the proforma invoice as supporting documentation. Additionally, many banks will require a proforma invoice in order to process an international wire transfer. A proforma invoice can help make the payment process smoother and simpler.

Using a proforma invoice can provide some protection for buyers and sellers in case of problems with customs or other authorities. For example, if there is an issue with customs clearance, having a proforma invoice can help prove that the goods were purchased legally and should be allowed into the country. This can save both buyers and sellers a lot of time and hassle.

Common Mistakes to Avoid When Using Proforma Invoices

When using proforma invoices, it’s important to avoid common mistakes that can cause confusion or delays in payment. Here are a few mistakes to watch out for:

1. Failing to include all necessary information: Make sure your proforma invoice includes all the necessary details, such as item descriptions, quantities, and prices. This will help prevent misunderstandings and ensure that your customer understands what they’re paying for.

2. Not labelling the document clearly: Make sure your proforma invoice is labelled as such. This will help prevent confusion with other invoices and ensure your customer knows what they’re receiving.

3. Sending the invoice too early: It’s important to time your proforma invoice appropriately. If you send it too early, your customer may not be ready to pay yet. On the other hand, sending it too late could delay payment and cause unnecessary frustration.

By avoiding these common mistakes and ensuring that your proforma invoices are accurate and timely, you can help streamline the payment process and maintain positive relationships with your customers.

Conclusion

In conclusion, a proforma invoice is a preliminary document sent to a client before the actual sale transaction. It details the goods or services that will be provided along with their cost, taxes, and any other charges related to the sale. Proforma invoices are used for various reasons, like facilitating international trade, customs clearance, obtaining payment from clients in advance, and more. Creating accurate proforma invoices ensures smooth business transactions and can help avoid misunderstandings or client disputes. To learn more about creating effective proforma invoices and avoiding common mistakes, check out our comprehensive guide on proforma invoicing for beginners.